Spend well. Save more.

A simple system to help households make better daily money choices before bigger financial decisions.

Cash flow clarity creates the guardrails for confident planning - with one, many people find hundreds or even thousands each month to redirect to what matters most.

Money is not a math problem!

Our success with money is closely intertwined with our behaviour, mindset, and actions. As a CCS™, I will partner with you in creating a strategy to help you learn exactly where your money goes and what amount to spend freely to automatically reach your financial dreams.

Does this sound familiar?

If so, you’re not alone - and you’re exactly who this is built for.

☑️ I make good money, but I’m not sure where it all goes by the end of the month

☑️ I have debt, but also want to save for my future

☑️ I never have money to pay my taxes each year

☑️ Big money choices often feel stressful or confusing - and honestly, I don’t feel confident I can afford this

☑️ You want confidence - not guesswork - with your money

If you nodded yes to even one - keep reading.

On average, I find $200 - $1,200 a month!

Can your current financial advisor report to you on your spending patterns and how they affect your short-term and long-term dreams?

Imagine achieving your dreams with one number.

A number that has already taken care of your bills and liabilities.

A number that pays down your debt.

A number that automatically contributes towards your short and long term dreams.

A number that shows how much you have left to spend.

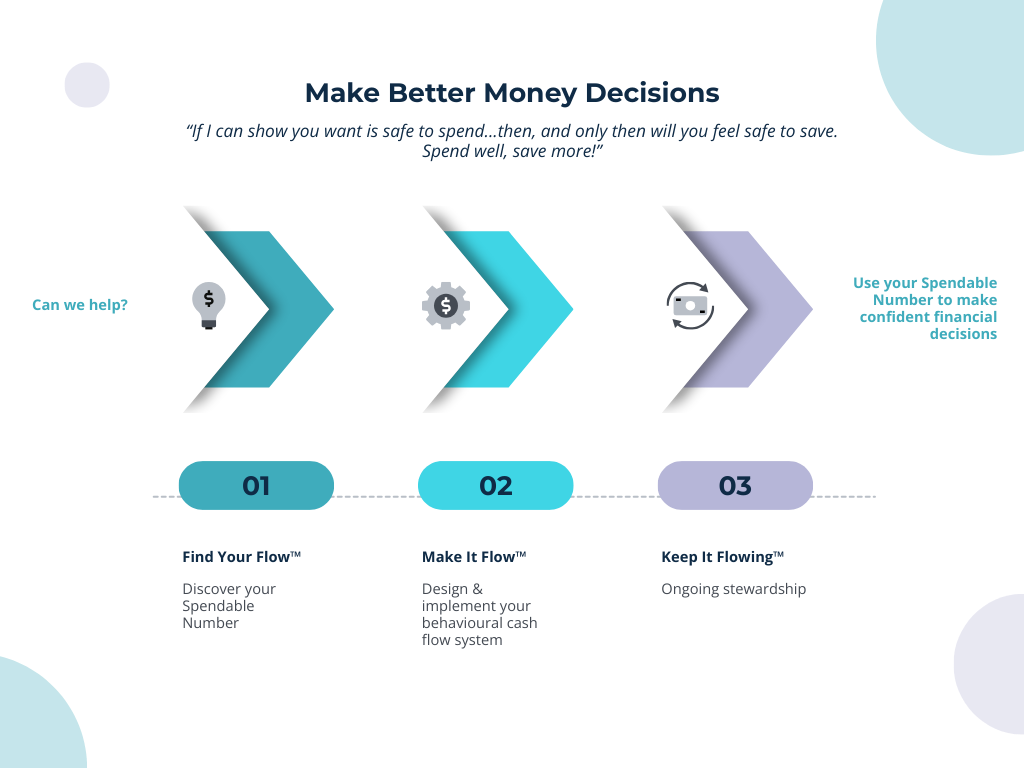

How The Spendwell System Works

What people are saying

What People Are Saying

“Hans helped me organize my money in a way that I've never done before. I now have an account for my taxes, my HST and I also have an account for vacation!

I know exactly how much money to keep and where, every month. It's an organizational tool that has helped me immensely.”

— Amanda C.

“My finances used to be all over the place. With Hans, financial planning just became more fun! He explained things so I would understand them and adapted my plan to my way of life.

Who would have thought, just give your money a job!”

— Christy P

Where To Begin?

Here are some options.

For Individuals

A done-for-you, one-on-one money coaching program to help you build savings, decrease debt and create financial security designed with the money you already have, while spending guilt-free.

This 3-month program will teach you what is safe to spend each month through a curated spending plan, using strategies aligned to your behaviour, mindset and actions leading to stress-free financial management.

For Families & Couples

This done-for-you, one-on-one money coaching program has everything included in the “Spendwell For Individuals” except it’s built for two or more!

Say goodbye to excel spreadsheets as this 3-month program will teach your household what is safe to spend each month through a curated spending plan, using strategies aligned to your behaviour, mindset and actions leading to stress-free financial management.

For Business Owners & Entrepreneurs

This 6-month money coaching program is designed to teach you how to increase profitability and pay yourself first!

This approach to cash flow management helps business owners and entrepreneurs alike ensure you make a profit and are paid for the hard work you do, allowing you to support your lifestyle by giving you the opportunity to focus on what matters most.

Try a session for free and see if it’s right for you.

There’s no commitment, pressure, or obligation.

Behaviour is key!

Your Money Mindset will help you explore your behaviour and provide insight into your relationship with money.

We respect your privacy.