Clarity Before Tax Time. Strategy Before Decisions.

Most people only see their numbers after it’s too late to change the outcome. This approach starts with cash flow - so planning is proactive, not reactive.

Money Clarity for Tax Decisions - Without Guesswork

Accountants play a critical role in preparing and filing tax returns accurately and compliantly. They do important work. They apply the rules accurately, prepare returns properly, and make sure everything is filed the right way.

But by the time taxes are prepared, most of the decisions that influence the outcome have already happened. Where people often get confused is when tax outcomes are created.

That work is essential - but what we focus on is the window before tax filing - when cash flow, contribution timing, and structure can still change the result.

Opportunities to improve outcomes usually happen earlier, when cash flow decisions are still flexible.

That’s where proactive planning fits.

This isn’t just about writing things off.

It’s about understanding your cash flow early enough to act on it.

A conversation focused on keeping more of what you earn - before tax season locks you in.

Why pay someone else when you can pay yourself?

Most tax outcomes are decided before your accountant ever sees your file.

Tax strategies don’t appear on a return - they’re created by decisions made throughout the year.

What we focus on is the window before tax filing - when cash flow, contribution timing, and structure can still change the result.

Those decisions live in your cash flow, not in your filing.

No obligation. Just clarity

What This Session Actually Is

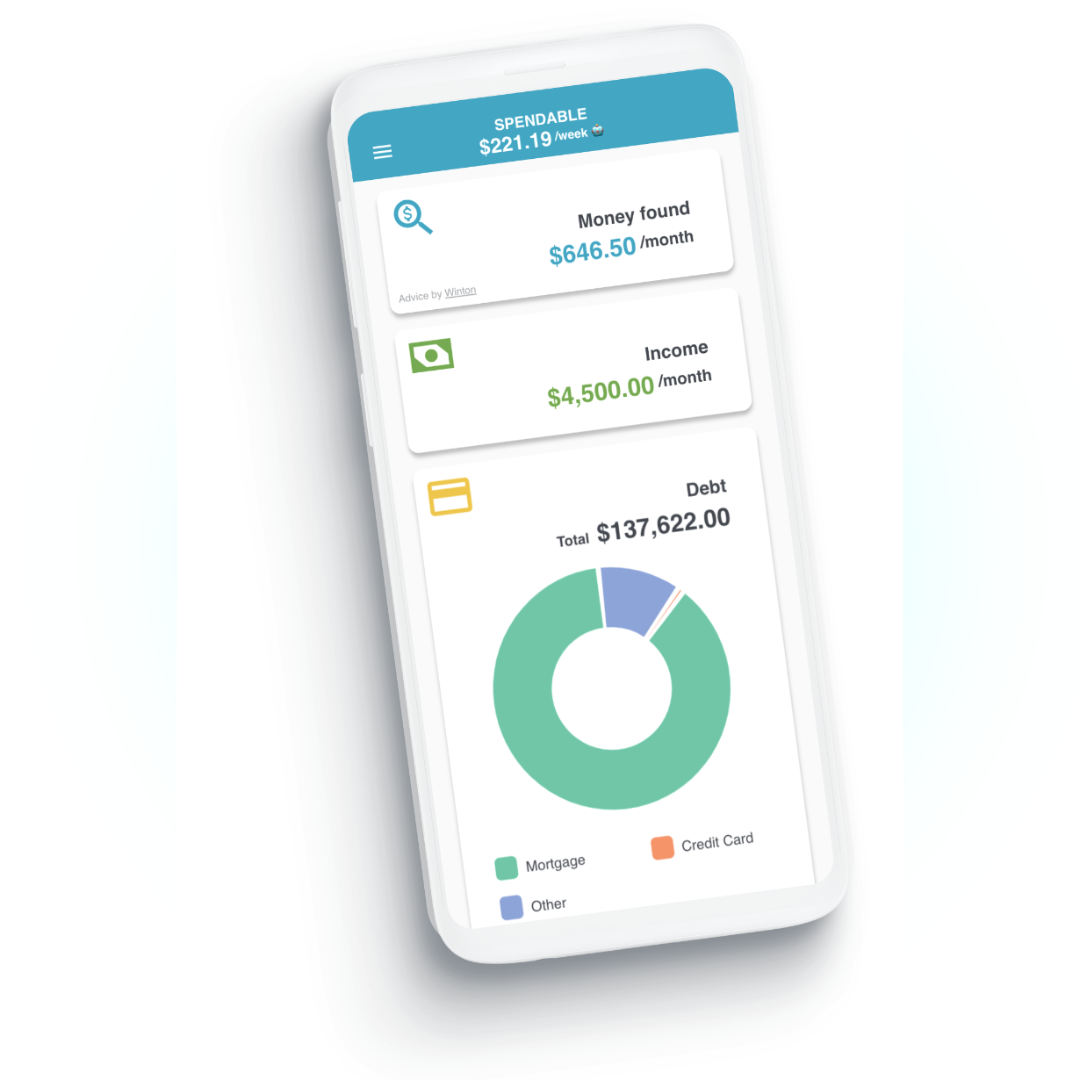

✔ A guided Find Your Flow cash flow review

✔ A proactive planning conversation before tax filing

✔ Coordination with a trusted CPA referral partner, when a mock tax return is needed

✔ Strategy recommendations based on your numbers - not assumptions

✔ Clear next steps, whether you act now or later

Important to know:

Tax preparation and mock tax returns are completed by an independent CPA referral partner and billed separately.

Our role is cash flow strategy, planning, and implementation support.

-

Choose a time that works - no prep required.

-

We map where your money is actually going. This is the foundation everything else builds on.

-

If needed, we connect you with our CPA partner for a mock return so you can see what’s possible before filing.

-

You decide what to implement - timing strategies, contributions, structure, or nothing at all.